Reason 3. Local governments are not receiving their fair share of transportation dollars.

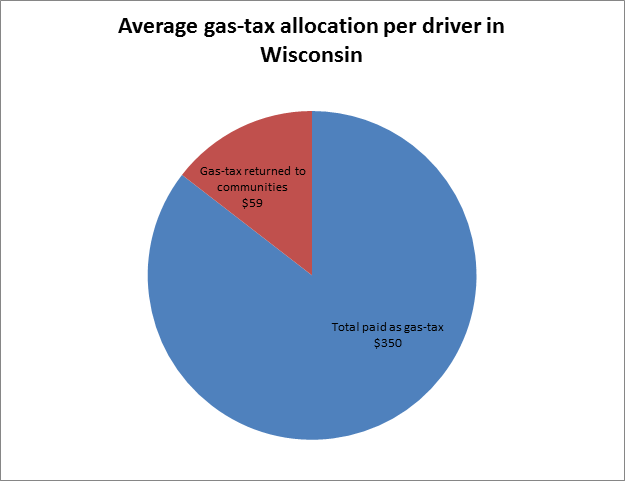

When motorists pay fuel taxes at the gas pump, they believe they are paying for the roads they use. However, this is largely a myth. The motor fuel taxes are paying for major freeway expansion but only a small portion of the local roads leading to the gas station. Why are local governments paying for the maintenance of local roads from their own pocket, when they are entitled to Transportation Fund dollars?

• 80% of the costs of maintaining local roads are paid for by non-user fees such as local property taxes.

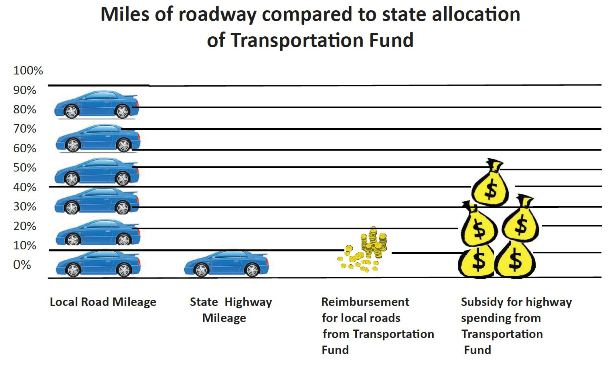

• A majority (over 63%) of the user fees collected goes towards state and federal highways.

• State law allows local units of government to receive reimbursements of up to 85% of local roadway maintenance expenditures; however towns, counties and cities were only paid an average of 24% of their eligible reimbursements in 2009.

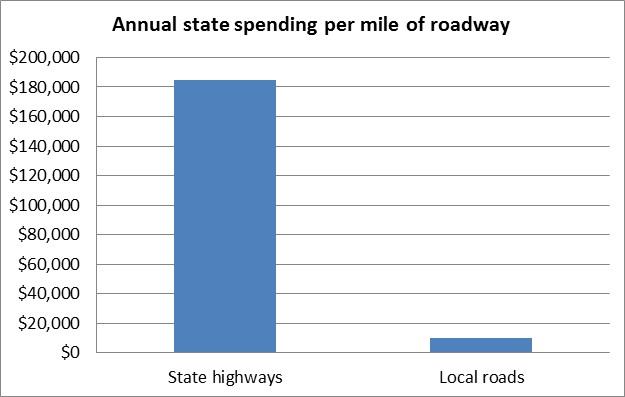

• 90% of the roads in the state are local roads but they receive only 25% of user-fees, while state highways comprise 10% of all roads in the state but receive 60% of user-fees.

Why is the state government spending millions of dollars in new highway capacity expansion projects when people are driving less – and local governments, in many cases are being forced to neglect the safety and vitality of their roads?

Check out Reason 1 and Reason 2 and check back tomorrow for the next reason why WISDOT budget needs to change.